The Business of Art

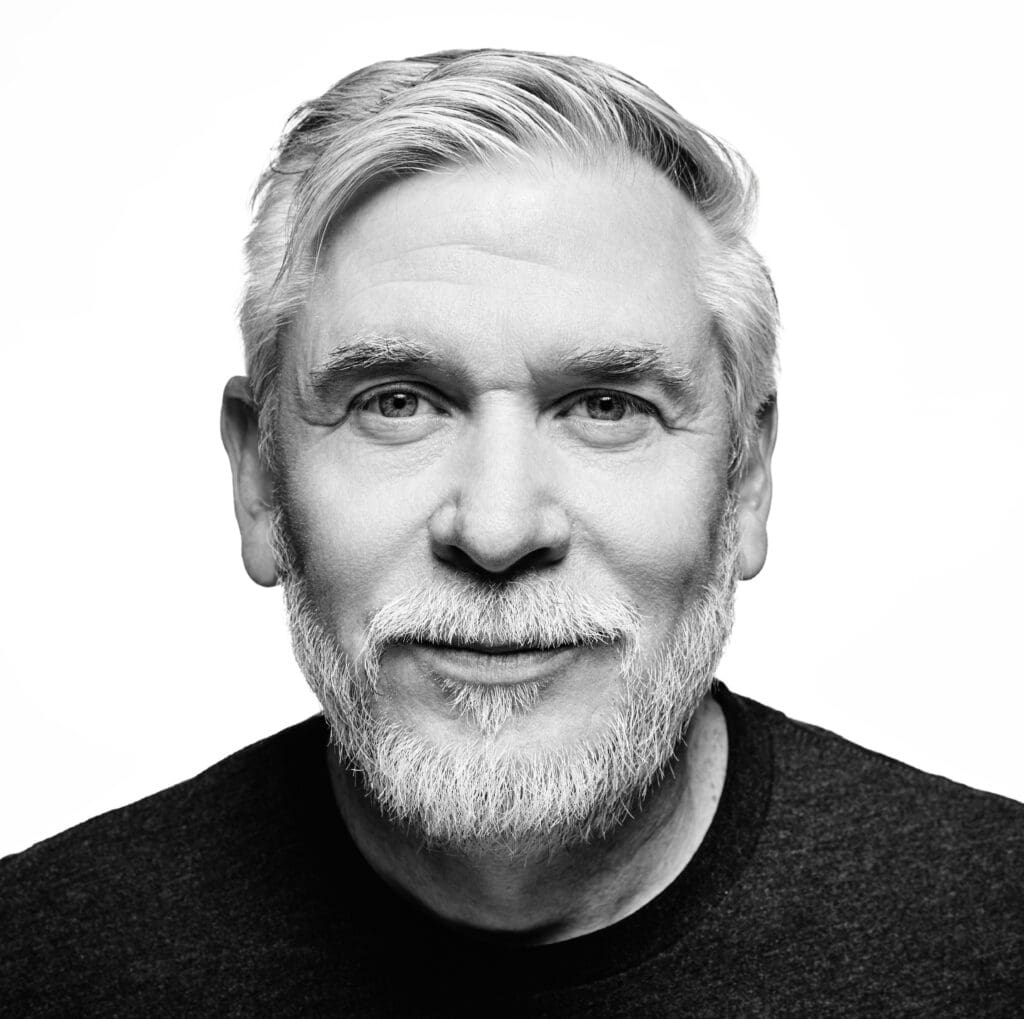

keynote speaker

joshua davis-ruperto

Executive Director of the Illinois Arts Council

Joshua Davis-Ruperto has served as Executive Director of the Illinois Arts Council (IAC) since 2017, following previous roles as the agency’s Deputy Director and Program Manager. Under his leadership, the IAC underwent a comprehensive redesign, including staff reorganization, restructured granting opportunities, and a revamp of its website and marketing strategies. His efforts led to a 500% increase in the agency’s budget and, in partnership with Arts Alliance Illinois, the creation of the Illinois Creative Caucus.

Prior to his work with the IAC, Joshua taught undergraduate courses at Brandeis University, worked in development at Steppenwolf Theatre, and contributed to urban planning projects for the architecture firm SOM. At the National Endowment for the Arts, he helped run the Education Leaders Institute, a national initiative aimed at strengthening arts education through collaboration with legislators and policy leaders.

Joshua is also a Jeff Award winning accomplished theater artist, having performed with companies such as the Berkshire Theatre Festival, Goodman Theatre, and Chicago’s Second City.

His board and committee service includes Arts Midwest, Ruckus Theater, Tympanic Theatre, the Chicago Inclusion Project, Windy City Performing Arts, and the National Assembly of State Arts Agencies.

He holds a bachelor’s degree from Western Michigan University and a master’s degree from Brandeis University.

2026 presenters and vendors

Jeffery Noble of Mouve Film

lawyers for the creative arts

arts alliance

turner center for entrepreneurship

illinois humanities

peoria art guild

peoria public library

illinois arts council

Interested in supporting this transformational day for our creative community?

Special Thanks To: